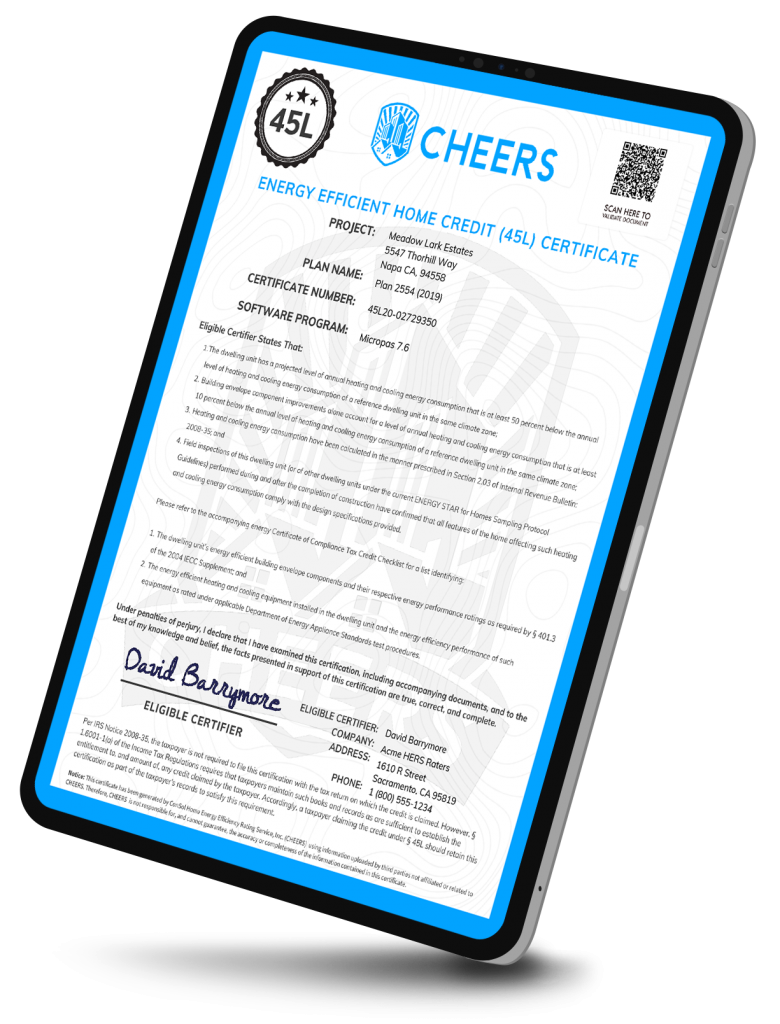

45l tax credit form

Real estate developers can claim 2000 per dwelling or residential unit on. The 45L tax credit allows taxpayers to claim potentially significant credits for the construction of new energy-efficient homes.

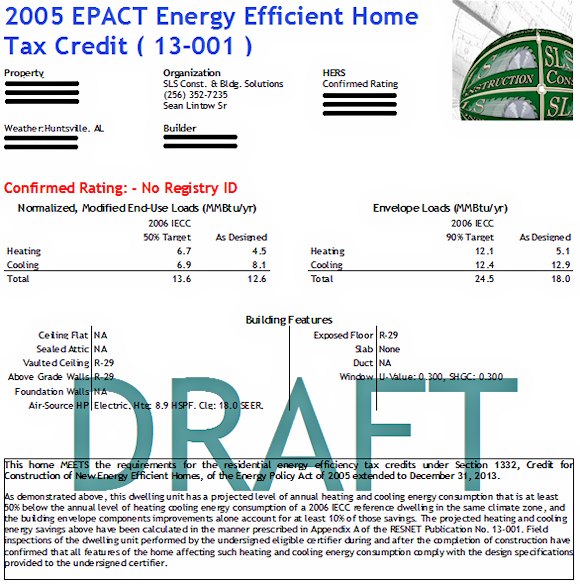

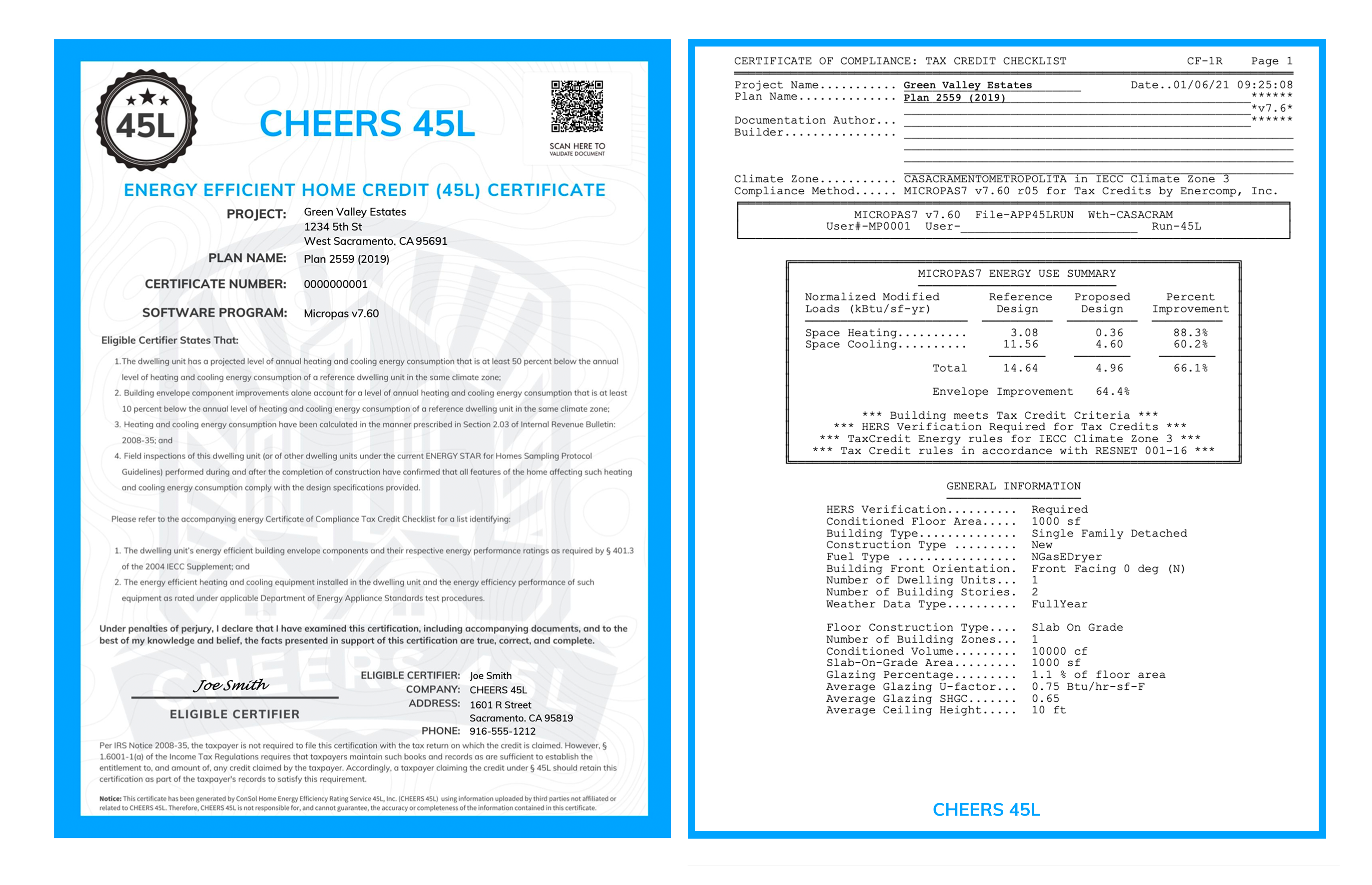

45l Tax Credit Services Using Doe Approved Software

Through recent passage of a new tax extenders bill the energy efficient home credit the 45L credit which provides eligible contractors with a 2000 tax credit for each energy efficient dwelling unit is retroactively available for projects placed in service from 2018 to 2020 and through the end of 2021.

. 2 Form Any certification described in subsection c shall be made in writing in a manner which specifies in readily verifiable fashion the energy efficient building envelope components and energy efficient heating or cooling equipment installed and their respective rated energy efficiency performance. Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings. The credit is typically not available a person eventually residing in the home.

1865 Further Consolidated Appropriations Act at the end of 2019. Schedule K-1 Form 1065 Partners Share of. THE 45L ENERGY EFFICIENT HOME CREDIT.

Section 45L provides a credit to an eligible contractor who constructs a qualified new energy efficient home. The 45L Tax Credit originally made effective on 112006 offers 2000 per dwelling unit to developments with energy consumption levels significantly less than certain national energy standards. Enter total energy efficient home credits from.

Under the provisions of the 45L tax credit eligible contractors may request up to a 2000 credit for new energy-efficient systems and installations in units leased or sold in what is currently an open tax year through December 31 2021. What is the 45L Tax Credit. The 45L was established to help and encourage builders manufacturers and developers to construct more energy efficient buildings.

Builder files 45L Tax Credit IRS form 8908. I am currently getting the certification necessary to claim 45 L tax credit. The term 45L comes from the federal statute called US Code 26 Subsection 45L.

These valuable credits are overlooked due to a lack of understanding about the qualification process. This incentive was a program enacted back in 2006 and signed with updates as of. The cost of Quality Builts 45L Certification process ranges from 249 to 749 per home address.

The credit is typically not available a person eventually residing in the home. IRS Form 8908 is used to claim the 45L tax credit. The developer would be eligible for 600000 in 45L credits in 2019 and 200000 in 45L credits in 2020.

Is Quality Built a qualified. IRS Form 8908 is used to claim the 45L tax credit. The 45L Energy Efficient Home Credit offers builders developers a 2000 federal tax credit per energy efficient home 2000 per qualified home Single family and m ulti-family projects up to three stories including condos apartments assisted living and student housing can qualify.

The manufactured home must have a projected level of annual heating and cooling energy consumption that is at least 30 below the annual level of heating and cooling energy. Read on for eligibility requirements and then submit a 45L. The 45L Energy-Efficient Home Tax Credit is equal to 2000 per residential unit or dwelling to the developers of energy-efficient buildings.

For qualified new energy efficient homes other than manufactured homes the amount of the credit is 2000. Currently the 45L Credit allows eligible developers to claim a 2000 tax credit for each newly constructed or substantially reconstructed qualifying residence. The tax credit was retroactively extended from December 31 2017 to December 31 2020 by HR.

The 45L credit which previously was set to expire on December 31 2020 allows the eligible contractor of a qualified new energy-efficient dwelling unit a 2000 tax credit in the year that unit is sold or leased as a residence. Once the certifier has provided you with all the certifications you need you will have to use IRS Form 8908 Energy Efficient Home Credit to file for the 45L tax credit. Contact us for details.

Claiming Energy efficient 45L tax credit using 8908 form for a new fourplex construciton I have a new fourplex built and leased in 2019. A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed. An eligible contractor is the person or entity who owns the.

A dwelling unit qualifies for the credit if--. The qualified contractor typically the developer builder or homeowner is the only person who can claim the 45L tax credit and must own the unit at the time of construction or improvement. 2021 45L Tax Credit Update DPIS Builder Services Helps Builders Take Advantage of the 45L Energy Efficient Home Tax Credit.

The 45L program is the best kept secret among developers and builders. The actual form to fill out with taxes is not even half a page and not that intimidating. The Internal Revenue Code IRC Section 45L is a 2000 per dwelling unit 1000 for manufactured homes tax credit for each new energy-efficient home which is constructed by an eligible contractor and acquired by a person from the eligible contractor for use as a residence during the tax year.

Energy credit part of the investment tax credit must not again be considered in determining the energy efficient home credit. Qualifying properties include apartments condominiums townhouses and single family homes. A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed.

The 45L credit is claimed on IRS Form 8908. The credit can be taken on amended returns or carried forward up to 20. As part of the New Energy Efficient Home Tax Credit under Code Section 45L a 1000 credit is also available for an eligible contractor with respect to a manufactured home.

Eligible contractors use Form 8908 to claim a credit for each qualified energy efficient home sold during the year. Provides 45L certificates to the builder. The 45L is a tax credit available to builders and developers who financed the construction of energy efficient homes and then sold or leased them.

It applies to single family homes apartments condominiums assisted living homes student housing and other types of residences. The Act has extended the 45L credit for qualifying units initially leased or sold through December 31 2021. The credit is reported on IRS Form 8908 Energy Efficient Home Credit.

Inspections must be performed by Quality Built and pass in advance of certification. In order to claim the credit a licensed third-party through must conduct on-site testing and energy modeling to produce a certification package with a declaration that the dwelling unit is 50 more energy efficient than a.

How Does The 45l Tax Credit Work Energy Diagnostic

45l Tax Credit Extended For 2021 Homes Ducttesters Inc

Taxes Paparazzi Business This Post Is Intended To Help You Be Organized This Year And Help Yo Paparazzi Jewelry Images Paparazzi Jewelry Paparazzi Consultant

179d Tax Deductions 45l Tax Credits Source Advisors

Dpis Builder Services 45l Energy Efficiency Tax Credit

Word Tax In Clamp Tax Reduction Concept Business Tax Tax Services Business Tax Deductions

The 2 000 45l Efficiency Tax Credit What You Need To Know Attainable Home

45l Tax Credit Services Using Doe Approved Software

Paparazzi Accessories Taxes Info Paparazzi Paparazzi Fashion Paparazzi Jewelry Displays

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

The 45l Tax Credit Is Expiring Again Cheers 45l

Taxes Paparazzi Business This Post Is Intended To Help You Be Organized This Year And Help Paparazzi Consultant Paparazzi Fashion Paparazzi Jewelry Displays

Taxes Paparazzi Business This Post Is Intended To Help You Be Organized This Year And Help You With Ta Paparazzi Jewelry Displays Paparazzi Fashion Paparazzi